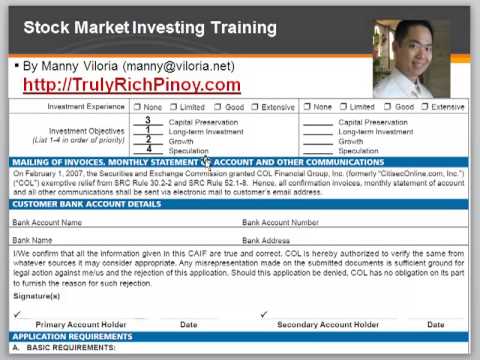

Good morning. I hope you're doing well today. We are going to learn how to fill up the City Sack online or call financial application forms so that you can easily buy and sell stocks online. When you go to the truly rich Pinoy com website, you will find a link that shows you how to download the call financial application forms. It is a PDF file and inside the file, you will see the customer account information form. I suggest printing out the form and filling it up by hand. You can check the for individual or joint, depending on whether it's for you alone or for you and your spouse or others. If it's for a minor child, you can put their ITF (in trust for) information. In this example, we will focus on the individual. Please fill up the fields using block letters and all capital letters for your last name, first name, and middle name. Please indicate whether you are male or female. Please provide your date of birth, place of birth, and citizenship. For OFWs and other Filipinos based here in the Philippines, please provide your mobile number as Call Financial may contact you via your cell phone. Moving down, please provide your email address as this is where they will send notices and other important information. Please provide your residential address, whether it's in the Philippines or outside if you are based in the Middle East or other countries. Please indicate your civil status, whether single, married, or other. If it's a joint account, please provide the necessary information for the non-primary account holder. For employment status, please indicate whether you are employed or not. If applicable, please provide your tax identification number and SSS number. Also, provide the name of your employer, office...

Award-winning PDF software

Fincen 107 Form: What You Should Know

For the purposes of this rule: (1) “Exchanger” means any person who has in their business the act of buying, selling, transacting, exchanging or in any way disposing or re-paying money or currency, or who offers to do so, in consideration of a financial arrangement including a money transmitter license or other money transmitter license issued under a state of the United States law; (2) It does not exclude a person who only has an office or other place to do business solely for the purpose of engaging in such a transaction. Registration of Money Service Business Fin CEN Form 107, Registration of Money Services Business. The applicant must provide the following information: a. Name; b. Address; c. Telephone number; d. E-mail address and a designation for what form of electronic transmission to use to send the information; e. An identification of the money services business; f. Identification of the person or entity authorized by such owner or owner's authorized person to act on behalf of the applicant in the state and country of the applicant's actual residence in connection with any registration required by this part; g. The names, addresses, and telephone numbers of two persons responsible for the maintenance of an up-to-date registration list of money services business; h. A certification that the information provided is correct. e. A statement that the applicant is the owner or person who has the authority to act as owner for the business for which registration is sought, and that the applicant meets all the requirements required by this part. Form 107 is not a substitute for an actual registration by the state of the United States of the applicant's name, address, and date of birth; an actual registration should be filed. The application should be accompanied by a completed application and any additional information required in this Fin CEN document. For information on how the applicant may be found in Fin CEN's BSA E-Filing System, CLICK NOW (). The Fin CEN Form requires that the applicant provide the following basic information: a. A complete and accurate name; b. Name on federal financial institution registration and report of foreign banking operations as required by 31 U.S.C. 5318(g)(6); c. Date of birth; d.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fincen 107, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fincen 107 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fincen 107 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fincen 107 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form Fincen 107