Hello and welcome to Currency Transaction Reports Simplified, presented by Compliance Simplified and BankinCuCompliance.com. We are going to review when to file a CTR and how to complete the forms accurately and completely. Now let's jump right in. When do we file a CTR? Well, a Currency Transaction Report must be completed for any transaction exceeding $10,000 in cash and must be filed within 15 days of the transaction. That's $10,000 and a penny or more. A reportable transaction can be the combination of several transactions throughout the day or one specific transaction if they aggregate more than $10,000 in currency and benefit one customer. Some examples include the cashing of a check or a group of checks, deposits, withdrawals, and exchanging of currency (for example, the exchanging of smaller bills for larger ones), a loan payment, or the cashing of savings bonds. For CTR purposes, you must treat multiple transactions occurring on the same business day and for the benefit of a single customer as a single transaction. Remember, a deposit made to a joint account benefits all account holders, not just the person initiating the transaction. For example, if a husband and wife have a joint account, and he comes in and deposits $7,000 in cash to their joint account on that same business day, and she comes in and makes a $5,000 cash deposit to her individual account, you are required to file a CTR reporting the $12,000 in cash that the wife received benefit of that day. Most modern computer systems create reports that help you identify these tricky situations, but regardless, this is an example of a reportable transaction. Now let's work on filling out the form. FinCEN requires financial institutions to electronically file CTR reports through the BSA e-filing system. They no longer permit paper filings...

Award-winning PDF software

Fincen new ctr 2025 Form: What You Should Know

The new file is expected to be released on May 31, 2018, (no extension, the deadline). Fin CEN Currency Transaction Report (CTR) Update The following are changes to the Fin CEN CTR filing instructions. There have been some concerns by law enforcement authorities regarding the changes. The information in this update provides clarification on the following: · Clarification on the form which should be completed, and included in the filing · Clarification on the required file type (EPIC) for the submission of documents by the fin-cencurrency report The form used to prepare the CTR file will be PDF only and therefore, the document format will need to be revised. In the absence of a revised form (e.g. a revision to the form required by Fin CEN through their system) and in order to avoid further delays with filing the CTR, there is a new method to file to help expedite the process. The new file format will be based on EPIC and will use a .SDF extension. A .pdf conversion file will be created and used for file submission. For the guidance and information regarding this new filing method, please contact your CTR Coordinator with any questions. If you would like to complete your Fin CEN CTR filing through Fin CEN's e-Filing system, please refer to Appendix A. Payments that a foreign institution makes to a U.S. correspondent institution or to “an institution” that the foreign institution controls (e.g., a bank, a trust company that the Foreign Bank is a subsidiary or a trust company controlled by the Foreign Bank) may not be required to be reported to the Financial Crimes Enforcement Network (Fin CEN). To report these transactions to Fin CEN, you must comply with procedures in the United States. The “payment” refers to the financial services provided that the transaction is a payment that is received or made in a financial transaction, or that constitutes a payment on a demand deposit account that is maintained in the United States. However, transactions relating to the transfer of money, financial instruments, or other value are not excluded. Foreign banks that maintain accounts with U.S.

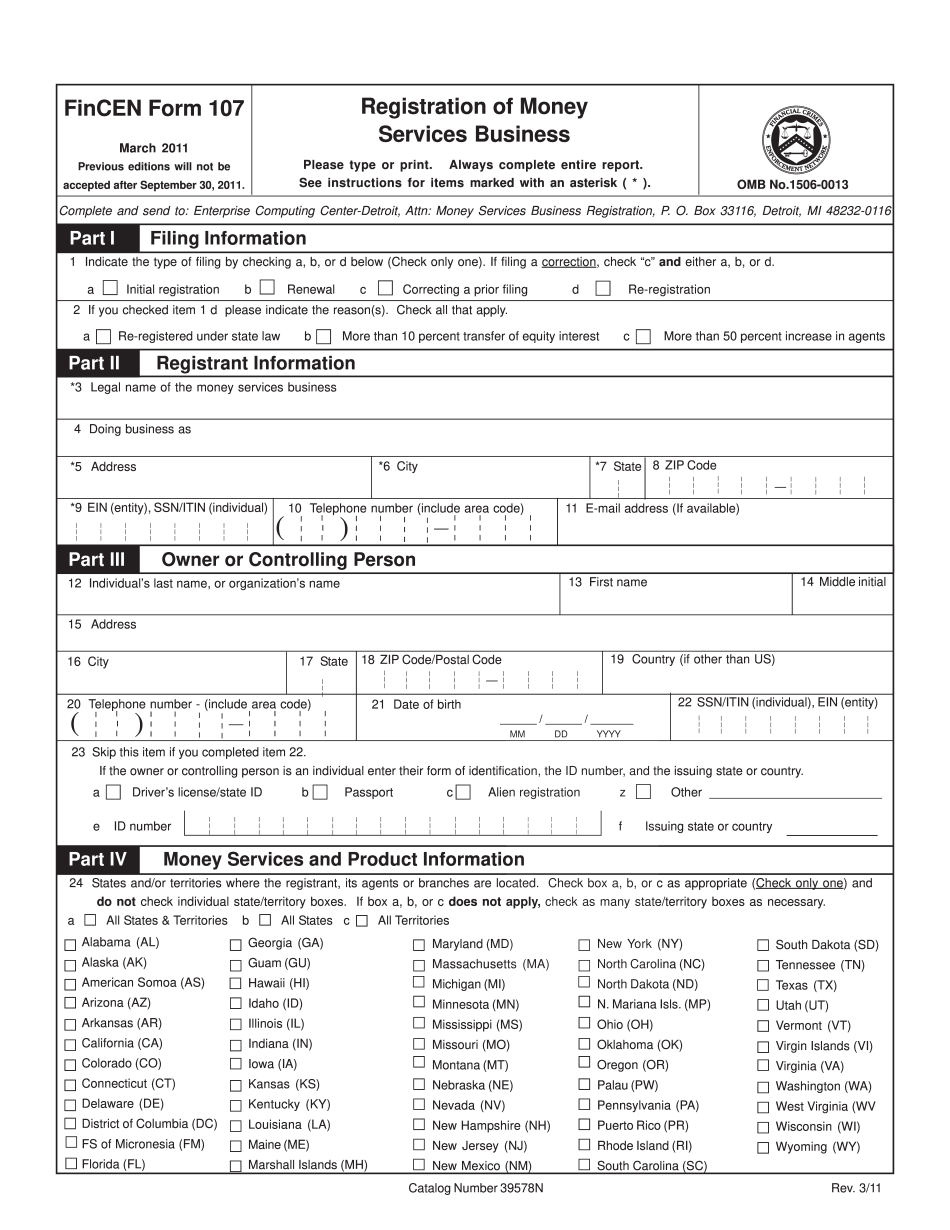

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fincen 107, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fincen 107 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fincen 107 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fincen 107 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fincen new ctr form 2025