Welcome to the topic of opening a bank account. If you have gone to a bank to open a bank account, you might have heard the words QIA and AML spoken by bankers. Have you ever wondered why KYC and what is KYC? Let's explore from a banker's perspective what these words are and how they are important. Here is a customer who wants to open a savings account urgently, but the bank is asking the customer to fill in a lot of details in the account opening form and submit documents. Estella wonders why. Why do you need so many documents? I am depositing my money. When the banker says "I had a wants the banks to north customer before opening an account, this is RBA policy." So we would like to know you more. Can you give us more information? What do you do and where do you live? The customer wonders why am I being interviewed. Customers have a lot of queries about KYC. Why is the bank insisting on so many documents and why are they asking banks to follow these processes? While bankers wonder how they should follow the KYC procedures, how should they ensure that they comply with the regulations? And students of banking wonder what is KYC even all about and money laundering? Have you heard of this word? It's an important element of the AML process. And you may think laundering means washing, so does money laundering mean washing money? And then what is sentimentai laundering? Have you seen how dirty clothes are put in a washing machine and the washing machine gives us clean clothes? Money laundering is similarly converting black money into white money. And how do they do it? They try to route it through the bank to convert black money...

Award-winning PDF software

Fincen Sar 2025 Form: What You Should Know

The SAR also identifies any suspicious activity that is related to money laundering. This includes cybercrime and cyberterrorism. Financial institutions that use this report as an initial report to law enforcement officers must file an SAR in accordance with SAR Regulations to be considered in good standing with Fin CEN and be able to process a Fin CEN SAR Report within a reasonable time. The Fin CEN SAR regulations outline the responsibilities of financial institutions to report certain types of suspicious activities and identify those which are related to money laundering. All financial institutions that use the Fin CEN SAR as an initial report to law enforcement officers must report suspicious activities in their reporting to Fin CEN and must do so within a reasonable time. Failure to file an initial SAR can result in serious financial penalties including loss of all money, reputation, and business relationships. Financial institutions are required to file an initial SAR if they identify any of the following: A suspicious activity report filed by a financial institution during a year may not identify, but must contain, one or more of the following: A. The identity of the taxpayer, or any person who is or appear to be acting as a substitute, provided in subsection (f); B. The nature of the transaction, including but not limited to the identity or quantity of money involved, date of transaction, amount involved, or the source and destination of funds in the transaction; C. The type of financial instrument used in the transaction, e.g. cash or wire transfer, or the identity of the financial institution where this transaction is conducted, and whether the reporting financial institution is a US or foreign-based financial institution, and whether the financial institution is a US or foreign-based money transmitting business if the transaction involves funds subject to US jurisdiction; D. A transaction which is not an authorized transaction or other transaction the financial institution reasonably believes the transaction is not intended for or for the account of the following: a. A United States person; b. A non-United States person or a person or institution in the United States, either directly or indirectly; c. A person in the course of an activity or transaction the financial institution reasonably believes the transaction is not authorized by the financial institution's policy; the policy should include, at a minimum, the following requirements: 1. The financial institution should obtain prior approval by its designated law enforcement officer on a case-by-case basis to release information to the appropriate law enforcement authorities; 2.

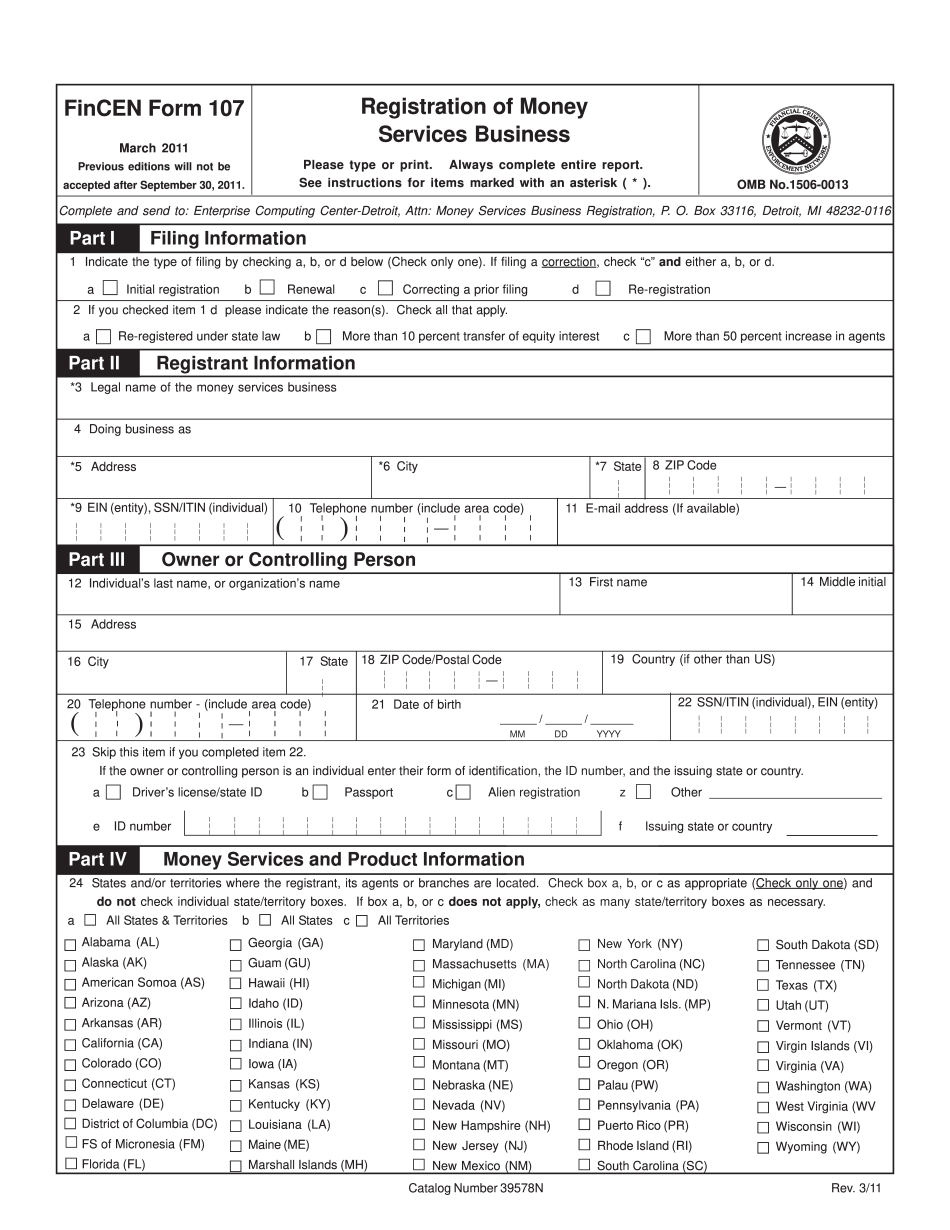

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fincen 107, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fincen 107 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fincen 107 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fincen 107 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fincen Sar form 2025