Bank Secrecy or Bank privacy is a legal requirement in some jurisdictions. This requirement prohibits banks from providing personal and account information about their customers to authorities, except in certain conditions. In some cases, additional privacy is provided to beneficial owners through the use of numbered bank accounts or other methods. Bank secrecy is prevalent in certain countries, including Switzerland, Lebanon, Singapore, Luxembourg, offshore banks, and other tax havens. The concept of numbered bank accounts was first established in Switzerland by the Swiss Banking Act of 1934. Bank secrecy is considered a fundamental aspect of private banking in Switzerland. However, Switzerland has faced criticism from NGOs and governments for allegedly being involved in the underground economy and organized crime. Instances such as the class action suit against the Vatican Bank in the 1990s, the Clearstream scandal, and the terrorist attacks of September 11th, 2001 have highlighted this issue. Former employees of Swiss banks like UBS, Julius Baer, and Liechtenstein's Light Group have testified that their respective institutions aided clients in evading billions of dollars in taxes by routing money through offshore havens in Switzerland and the Caribbean. One former employee, Rudolph M Elmer, described offshore tax evasion as a global problem and the biggest theft among societies and neighboring states. In an effort to address this issue, the Swiss Parliament ratified an agreement on June 17th, 2010, between the Swiss and US governments. This agreement allowed UBS to share information with US authorities regarding 4400 American clients suspected of tax evasion. Advances in financial cryptography, such as public key cryptography, could potentially enable the use of anonymous electronic money, anonymous digital bearer certificates, and anonymous internet banking. Institutions that issue such certificates and provide digital cash and secure computer systems play a crucial role in enabling these privacy-enhancing measures.

Award-winning PDF software

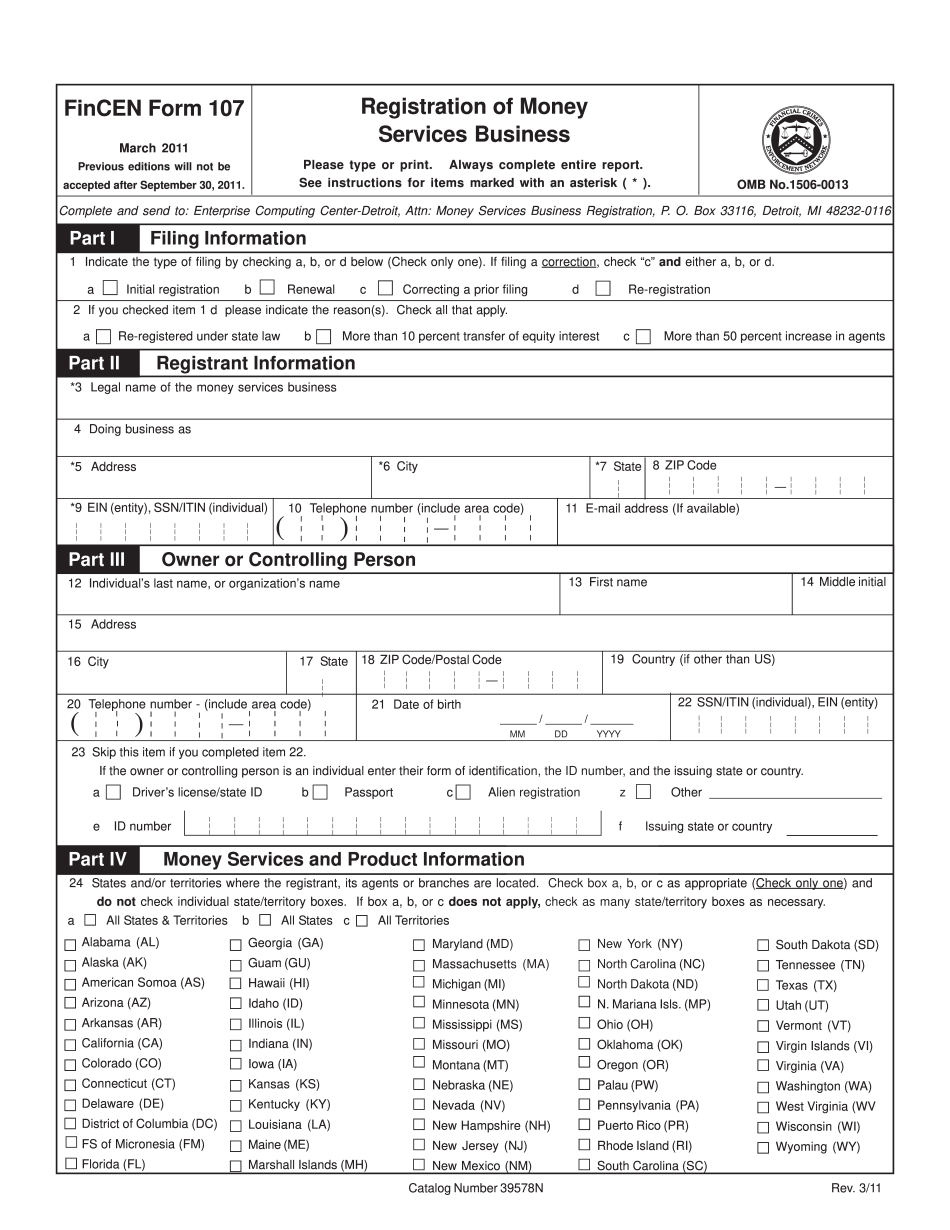

Fincen bank secrecy act Form: What You Should Know

This system allows you to electronically file your forms using an approved, secure method, such as the E-Filing System. For additional information on Bank Secrecy Act forms, see Fin CEN's E-Filing System website. How Does BSA E-Filing Work? The BSA E-Filing System facilitates the filing of BSA electronic forms as well as the use of faxes and other electronic transmission methods to electronically file your submissions. The BSA E-Filing System includes a user interface, an order entry panel and a secure database. Your BSA electronic submissions are reviewed by a Fin CEN representative to verify compliance with the BSA filing requirements. This process ensures that all the information on your financial institution forms are submitted in accordance with the information set forth in the regulations. How Do I File For an E-File? The system has a user-friendly e-filing mode, which allows you to send your electronic forms electronically through the System. You can also create forms on the E-Filing System and then send them to the filing organization. Who May Uses the BSA E-Filing System? The BSA E-Filing System is available to federal, state, and local government agencies, and to foreign financial institutions that have a designated compliance officer. BSA E-Filing System E-FILE System (US) E-FILE System (F) Fin CEN E-File System (US) Fin CEN E-File System (F) BSA E-Filing System (US) BSA E-Filing System (F) Which Business Entities May Uses the BSA E-Filing System? The BSA E-Filing System is available to federal, state, and local government agencies that meet the specified requirements. Please see the list of business entities you may contact if you have questions about the BSA E-Filing System. The National Credit Union (FCU) A Federal Credit Union (FCU) may use the BSA E-Filing System to file financial institution reports for its federally insured depository institutions. The federal FCU must have such a designated compliance officer to accept information in the BSA E-Filing System. This system is also available to the FCU to support the compliance of the FCU for deposit and credit union deposit accounts.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fincen 107, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fincen 107 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fincen 107 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fincen 107 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fincen bank secrecy act