The US Treasury Department's Financial Crimes Enforcement Network (FinCEN) has published a final rule under the Bank Secrecy Act. Before the rollout of this new customer due diligence rule, financial institutions did not have clear guidance on the requirements for identifying beneficial owners. This loophole allowed criminals and suspicious individuals to access the financial system anonymously. Now, that has changed. Financial institutions are now required to clearly identify their account holders and beneficial owners. Part of this process, called customer due diligence, includes developing comprehensive risk-related client profiles and conducting ongoing monitoring of transactions to identify suspicious activities. Beware, if not managed properly, the implementation of this new requirement will affect your bottom line. FinCEN estimates that the new requirements will cost over 100 million dollars. Time and money will be spent understanding the law, changing processes, making adjustments to policies and procedures, updating customer onboarding systems, updating and delivering training, and more. It sounds like a lot to worry about. Fortunately, Global Radar already offers everything you need to comply. Global Radar makes it easy to onboard new clients, manage existing client portfolios, complete investigations, produce management reports, and take corrective measures. Their comprehensive reports allow you to assess the effectiveness of your compliance policies, and you can quickly resolve any issues. The automated risk rating process allows you to quickly identify high-risk clients. Global Radar makes it easier to effectively implement and manage the requirements by eliminating the time-consuming and costly efforts. With Global Radar, there's nowhere to hide for criminals and suspicious characters. You'll be able to identify and analyze all your clients, meeting the new requirements without fear of fines and repercussions. Global Radar is the leader in client onboarding and surveillance. Visit globalradar.com and register for a demo today.

Award-winning PDF software

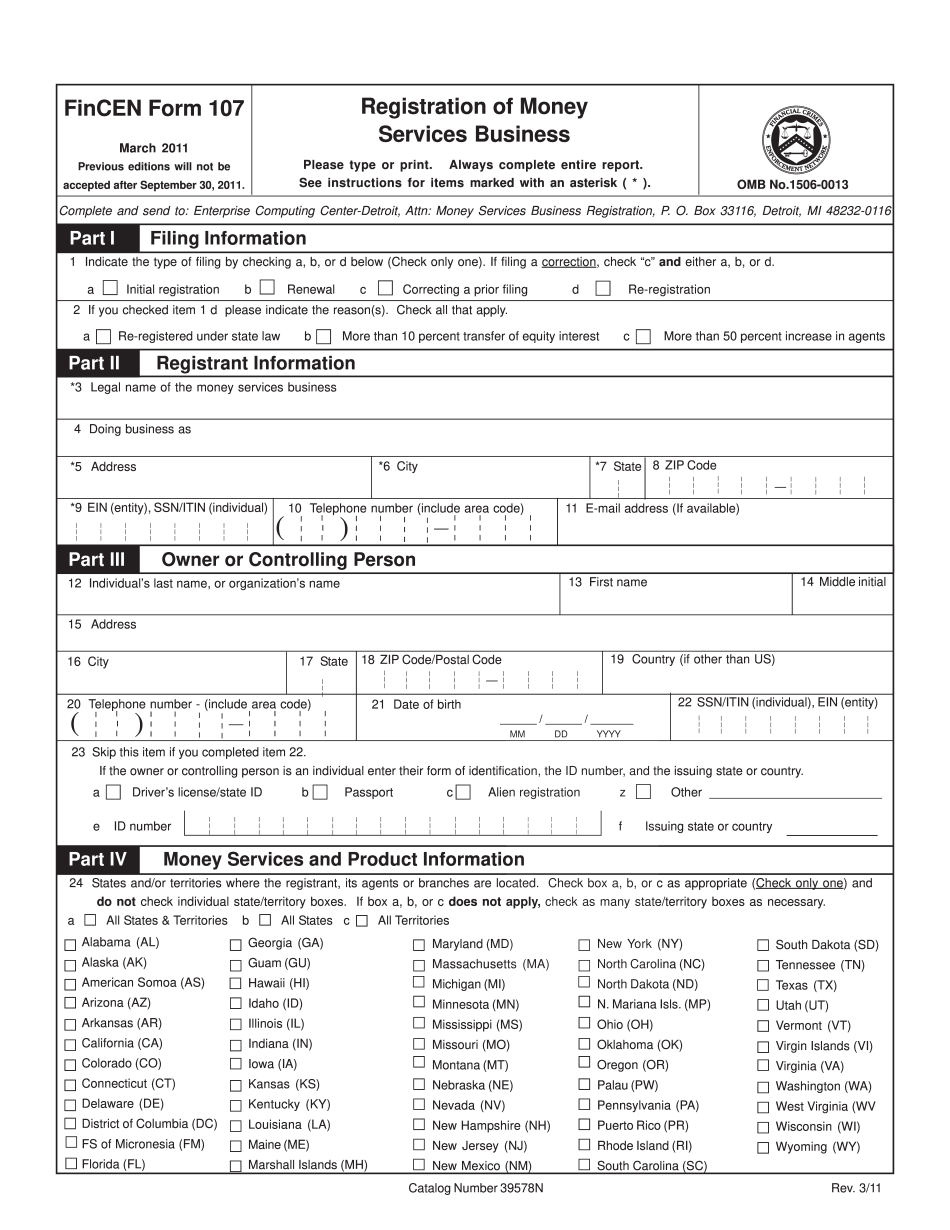

Bsa e filing system registration Form: What You Should Know

BSA E-Filing System. A filing organization filing with a Fin CEN authorized agent may submit required reports in advance of the due date. When a filing organization submits required reports ahead of a due date, we provide a service fee to facilitate the file.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fincen 107, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fincen 107 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fincen 107 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fincen 107 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Bsa e filing system registration