Welcome to my talk on analyzing the FinCEN files with Neo4j. - My name is Michael Hunger, and I have been leading the developer relations team at Neo4j for many years. - I am quite excited about this topic because it is recent and important. It involves an investigative use case that combines graph analytics and graph databases with investigative reporting, which is really cool. - In September, the International Consortium of Investigative Journalists launched a new investigation called the FinCEN files. They obtained a data leak from the Financial Crimes Enforcement Network, which is the U.S. agency of the treasury. The agency requires international banks to report suspicious activities related to money transfers. - The journalists did an interesting job with this investigation, and today we want to dive into it. - Neo4j has a long history of collaborating with the ICIJ. The collaboration started in 2014 with projects like "Lifted Looks" and "Swiss Leaks". - The ICIJ has been using Neo4j for many years to connect the dots in their investigations. It is like a detective investigation where having all the puzzle pieces is not enough if you don't see the connections. However, once you see how things, people, and events are connected, you can uncover much more. - The suspicious activity reports (SARs) are mostly reported by banks' compliance officers. They report activities like insider trading, money laundering transactions, transactions involving well-known criminal figures, suspicious senders or receivers, large money volumes, and dealings with shell companies. - Although banks are required to report these activities to FinCEN and the U.S. Treasury within a certain timeframe, they often fail to do so. - According to the ICIJ, these reports are often insufficient to make informed decisions. - The ICIJ investigations go deep and use data leaks as starting points. They conduct local investigations with the help of many...

Award-winning PDF software

Fincen machine learning Form: What You Should Know

Digital Identity and the Future of Fin Security There are more than 30.9 billion users connected to the Internet, with the vast majority in India. With a significant growth of more than 300 percent in India since 2011, the number of users and financial institutions in India, will likely increase significantly over the medium term. The increased penetration of mobile devices and increased Internet speeds, will enable financial institutions in India to reach more Internet-connected users with better customer service, greater mobile wallets and increased user traffic. FINDINGS & DISCLOSURES FINDINGS In May 2017, the Financial Action Task Force (“Fin CEN”) and the U.S. Department of the Treasury's Office of Foreign Assets Control (“OFAC”) jointly issued guidance regarding electronic enforcement. The guidance is an initial step in addressing Fin CEN and OFAC's commitments to “bring the full force of the financial reporting requirements” of the International Emergency Economic Powers Act (“IE EPA”) and the Comprehensive. Sanctions and Criminal Organizations Act of 1988 (“CSCA”). The guidance provides for a number of activities that assist Fin CEN and OFAC with the enforcement of United States laws. The guidance also clarifies the requirements for using information technology, such as technology to automate transaction entry, in the enforcement of U.S. laws, and identifies several areas of significant enforcement activity on the International Money Laundering Control Act (“AML”), particularly those related to electronic monitoring and reporting of suspicious transactions. 1. Background and Scope of Guidance: To further its role of promoting international and national cooperation and combating money laundering, Fin CEN and OFAC issued a seminar guidance to the financial industry in April 2025 to address a number of issues related to the implementation of AML. The guidance also provides guidance to financial institutions on the importance of implementing AML compliance systems and information sharing and encourages financial institutions to work cooperatively through appropriate authorities to promote financial stability by promoting the proper application of anti money laundering rules. In April 2017, Fin CEN released a new, updated version of its Guidance to Regulators on the Electronic Surveillance of Beneficial Owners (“ESB”) and the Compliance. With and Compliance With Bank Secrecy Laws (“CFS”).

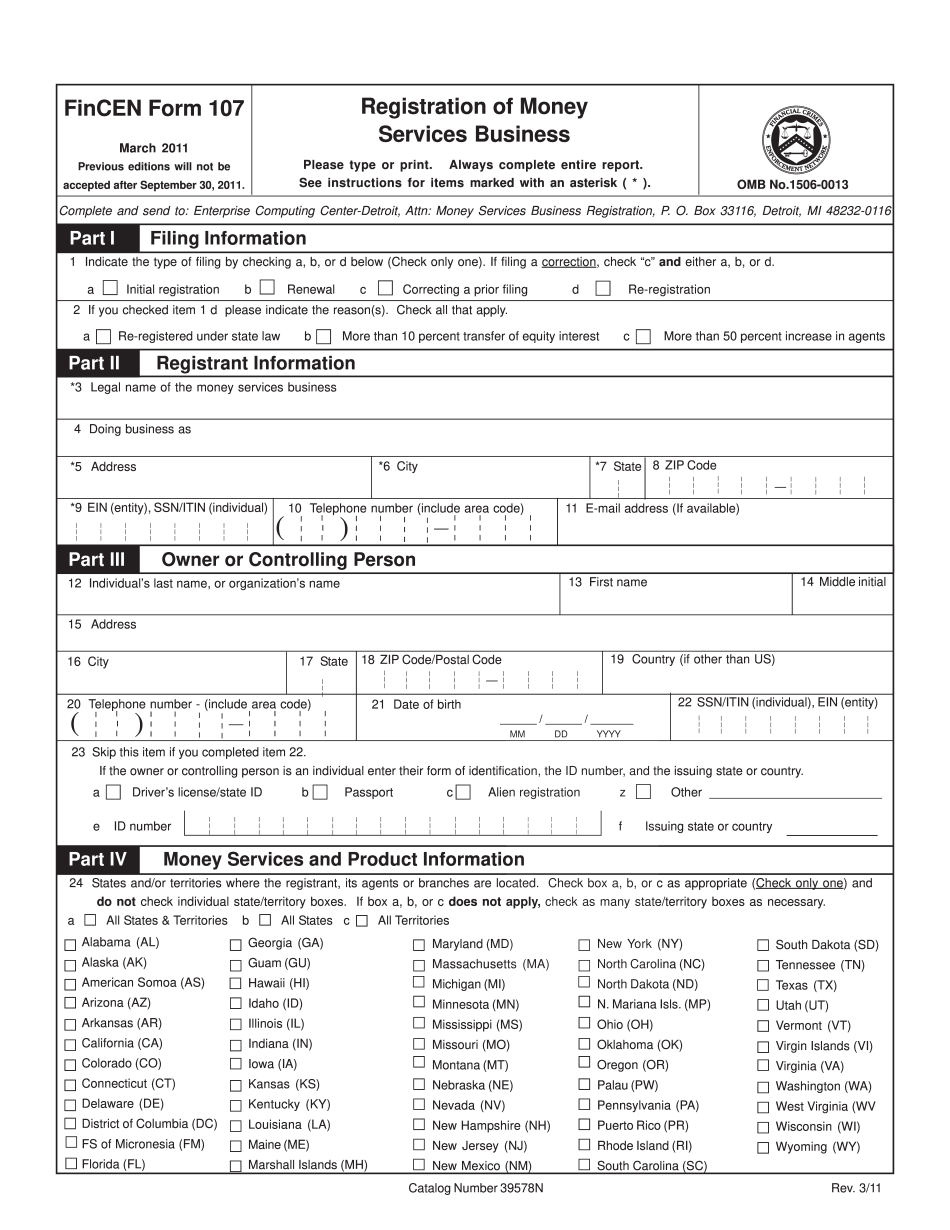

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fincen 107, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fincen 107 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fincen 107 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fincen 107 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fincen machine learning