Balancing regulatory compliance with improvements to customer experience is vital when tackling financial crime. Our reporter found out how Nice Optimize applies innovative technology to protect institutions, giving their customers more agility while also protecting them from criminals. Criminals are finding increasingly sophisticated ways of stealing money and ruining lives. It's crucial that banks and other financial institutions stay one step ahead by closing the loopholes and making themselves and us less vulnerable to attack. There has been a greater seismic shift in technology in the 20 years since Nice ACTA mize was set up than at any other time in history. The company is a market leader in financial crime risk and compliance. Their headquarters is in London, but they operate across the globe to help customers fight fraud and financial crime and maintain their compliance. But it's important to remember what this is all about. What is fighting financial crime supposed to achieve? It's about protecting people, building trust, and ensuring that those affected by fraud and financial crime are given the right levels of protection. It really is about putting the customer first. Imagine you have an incredibly smart accountant, and you scale that up by thousands. Imagine they are all looking at all the banking transactions that an organization has, and they're able to find patterns that indicate a crime has occurred. That's what the technology is doing. In a fast-moving market, software needs to constantly evolve. It's no longer just about adapting to change; it's crucial to adapt to the rate of change. We need to predict the criminals' next scam. Society has changed, with everyone using mobiles and computers all the time. We use our banks like websites, no longer going to a branch. And criminals know they can pretend to be us on...

Award-winning PDF software

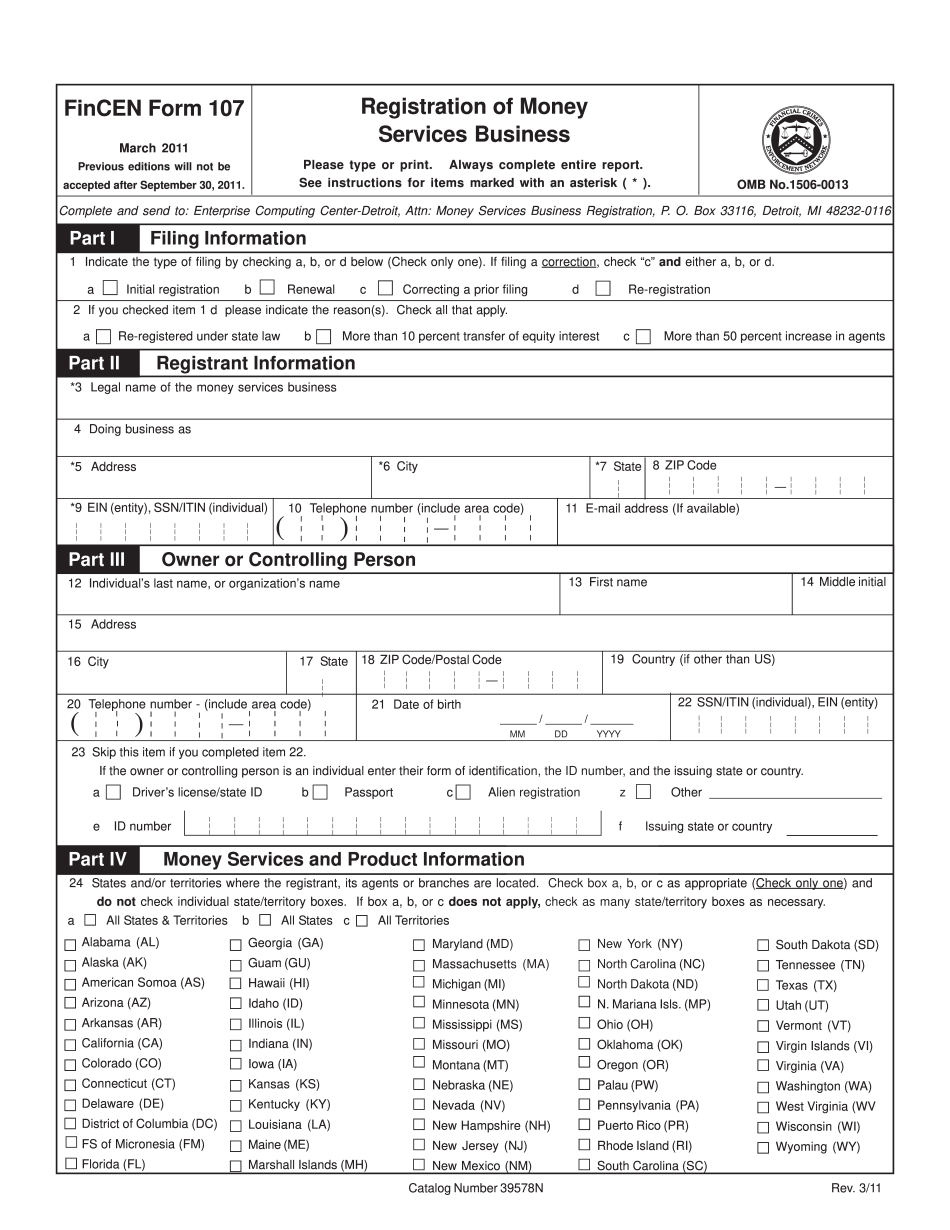

Fincen complaint Form: What You Should Know

In addition, the MoneyGram agent at the registration location gave the recipient's bank information to the MoneyGram agent at the reception location. To verify the payment, the MoneyGram agent sent the recipient's bank statement after the money was transferred. MoneyGram had the capacity to conduct an automated transfer through the MoneyGram Online Transaction System, or MOTS. Each transaction in which funds were moved may also be entered into MOTS from within the MoneyGram Online Transaction System or MOTT. Transactions that are not to be entered into MOTS from within the MoneyGram Online Transaction System or MOTT can be entered into MTT, which is a separate transaction system. Frequently Asked Questions for MoneyGram • Why did MoneyGram change its name from Money Gram to MoneyGram International? Since 1996, there were four different MoneyGram names. • What is an OCC? An “Operation Contaminant” is the term used by MoneyGram's “Crisis Solutions Group” to describe financial problems it is investigating. The group is made up of the top executives of MoneyGram USA, the parent company of MoneyGram International, and a small, handpicked group of independent attorneys that advise MoneyGram on its various legal and compliance matters. • Why was the Federal Trade Commission (FTC) investigating MoneyGram? The U.S. Department of Justice (DOJ) and the Federal Deposit Insurance Corporation (FDIC) both were investigating allegations that MoneyGram had disbanded its MoneyGram products and that the MoneyGram agents were running a “loan-shark” scheme that collected payday loans, car titles, installment loans, and credit cards, and then resold those loans at exorbitant markups to people who would not qualify for them under traditional credit. The FTC is seeking information from all MoneyGram customers who received letters from MoneyGram and if they received those letters to determine whether the MoneyGram service was provided or breached. The FTC believes that it has enough information to bring charges under the FTC Act of Consumer Fraud and Deceptive Business Practices (DFA) against MoneyGram. These types of business practices are commonly known as “payday loan” schemes.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fincen 107, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fincen 107 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fincen 107 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fincen 107 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fincen complaint