PDF IRS Form Fincen 107 2011-2025

Show details

Hide details

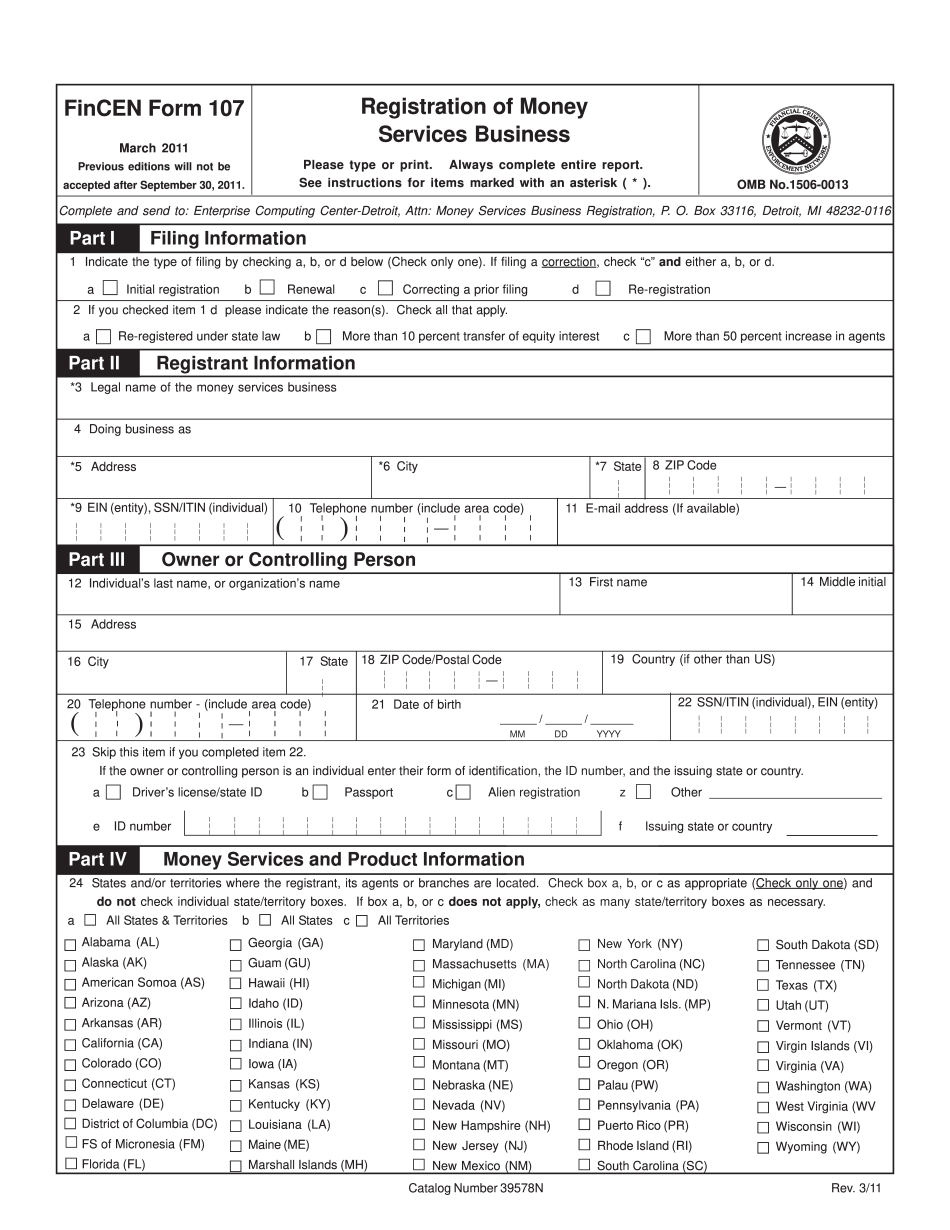

Ms on FinCEN Form 107 should be complete Part III and provide the requested completed fully and accurately. Renewals of the term money transmitter. must be submitted on a new Form 107. Photo copies of previously submitted forms or 6. See instructions for items marked with an asterisk. Previous editions will not be accepted after September 30 2011. OMB No*1506-0013 Complete and send to Enterprise Computing Center-Detroit Attn Money Services Business Registration P. O. Box 33116 Detroit MI ...

4.5 satisfied · 46 votes

form-fincen-107.com is not affiliated with IRS

Filling out Form Fincen 107 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guide on how to Form Fincen 107

Every citizen must declare their finances in a timely manner during tax season, providing information the IRS requires as accurately as possible. If you need to Form Fincen 107, our reliable and user-friendly service is here at your disposal.

Follow the instructions below to Form Fincen 107 promptly and efficiently:

- 01Upload our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official instructions (if available) for your form fill-out and precisely provide all information requested in their appropriate fields.

- 03Fill out your template using the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Take advantage of the Highlight option to accentuate particular details and Erase if something is not applicable any longer.

- 06Click the page arrangements button on the left to rotate or delete unwanted document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal report delivery.

Opt for the most efficient way to Form Fincen 107 and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Fincen Form 107?

Online solutions allow you to arrange your file administration and increase the efficiency of the workflow. Follow the quick information in an effort to complete IRS fine Form 107, stay away from errors and furnish it in a timely manner:

How to fill out a fine?

- 01On the website with the document, click on Start Now and go for the editor.

- 02Use the clues to fill out the pertinent fields.

- 03Include your personal information and contact information.

- 04Make absolutely sure that you choose to enter true details and numbers in correct fields.

- 05Carefully check out the data in the document as well as grammar and spelling.

- 06Refer to Help section in case you have any questions or address our Support staff.

- 07Put an digital signature on the fine Form 107 printable using the support of Sign Tool.

- 08Once blank is done, press Done.

- 09Distribute the prepared by way of electronic mail or fax, print it out or download on your gadget.

PDF editor permits you to make changes to the fine Form 107 Fill Online from any internet connected device, personalize it in line with your requirements, sign it electronically and distribute in several means.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form Fincen 107?

Your business name should be on the Form Fine 107. This form is used to get a trademark registration if you wish to do so (which is a legal requirement), or if you want to change the name of your business from “Marijuana Dispensary” to “Marijuana Retailer.” (The name of your business is not changed on the form.)

What are the penalties for not filing?

Failure to file your Form 150 may result in your name being published on Federal Register notices. If you knowingly fail to file your Form 150 then you may be subject to:

Federal criminal prosecution

A civil fine of up to 25,000 or three times the filing fee

Fines may be increased to triple the filing fee for repeated violations.

Who should complete Form Fincen 107?

An applicant should complete Form Fine 107 only if a request for a certificate of registration has been filed. This document is not required if registration was completed prior to filing a request for a certificate of registration or if registration under an approved form was previously granted. The form may be amended if a change has been made to the information provided in the application form.

Can I complete this form without a lawyer?

If the person signing the form is unable to give consent to the publication of the information, the person should not complete Form Fine 107. A lawyer should complete Form Fine 107 in a separate file. If a lawyer does not sign Form Fine 107 and the form is not completed by a lawyer, the application will be held as provided for in Section A of Appendix A of Form 2557 (Form 2557-S) (filed with the registrant, if filed).

If the application is filed with another agent, does the application have to be in the signature of the agent?

To the extent that a person has been issued a certificate of registration for a species that he or she does not own, the person is not bound by any of the provisions of this section if the person signs form 713 in his or her own name. The person may sign for another by signing form 613, if he or she is authorized to do so by the person to whom the signer is being added, and only as set forth in subsection (c) [5].

How is the fee for Form Fine 107 calculated?

The fee is three cents for each page in the file with the statement of taxon ownership. The fee is calculated by dividing 3 cents by the total number of pages on the form (including cross-references).

What happens if the form is returned as unprocessed?

Processed Form Fine 107 shall not be returned unless the fee has been paid and the form is completed by a lawyer (for Form Fine 107 when it is filed under the control of a lawyer) or, if filed with a separate agent of the applicant, has been signed by such agent.

What happens if form 733 is submitted after Form Fine 107 has been filed?

If the taxon is one listed in subdivision (1) of Section 33.07 or subdivision (2) of Section 33.08 of the Fish and Game Code, a separate fee of twenty-five dollars shall be charged.

When do I need to complete Form Fincen 107?

You are required to complete Form Fine 107 in accordance with Section 1 of Appendix F-2 of the Uniform Transmittal Requirements, and the following rules apply:

If filing electronically, your return must be printed and notarized. If submitting tax returns using paper Form 1040, Form 1040EZ, or Form 1040NR, send Form Fine 107 to the relevant state agency that handles tax returns (see Question 9). The agency will print forms on 8.5" x 11" paper for paper returns and 2.5" x 5" paper for electronic returns. The agency will deposit the forms in the appropriate office.

If filing on paper, the required forms must be filed with and mailed to the U.S. Postal Service no earlier than the 17th day of the second month following filing the tax return. Electronic returns received after 17 days before the due date are not accepted. You may file by email (using the IRS Email Forwarding System), fax, or mail. If electronically filing, your return must be printed and included with electronically filed returns.

Back to top

What is required on Form Fine 107?

To receive a form fee credit, you must file Form Fine 107 (Form 1040 or Form 1040EZ). If you wish to file electronically, you must print, sign, and file the form electronically using the IRS Email Forwarding System (see Question 9). There is no limit to the number of Forms Fine 107 you may file.

The form contains information required to be included on the Form 8379 or Form 4037, or accompanying papers, in lieu of the information contained on the form for the tax year for which the credit is being claimed. Additional information is required for returns filed in 2018 through 2025. If you do not send Form Fine 109, you must also send Form 1040X, or Form 1040NR, and a copy of Form 1040NR, as part of any electronic return filed in 2018 or later with a due date after the due date of a current tax return filed in 2018 or earlier. You must send all required information as stated in the Instructions for Form Fine 107. See also the list of Forms and schedules you must file with Form 8379 and Form 4037.

Can I create my own Form Fincen 107?

Yes.

What should I do with Form Fincen 107 when it’s complete?

As part of the processing of your Forms Fine 107, it may appear that you may have a tax liability with the IRS. If so, we encourage you to fill out the IRS Form 760, Corrected Tax Return and Payment Information. The form will be used to:

Complete the Form 1120S.

Resolve any tax obligations that existed on your Form 107 and you have no documentation available.

Make any adjustments or payments required by the statute of limitations on your tax liabilities (such as a tax return) and you have no documentation available.

If the IRS has information about your tax return that is not shown on your Form 107 and you have an address outside the United States, we encourage you to send us information electronically, such as your tax return information. We also encourage you to file the paper Form 1120S by sending it as a scanned PDF to; or by mail to Treasury Inspector General for Tax Administration, P.O. Box 1688, Cincinnati, OH 45.

If the IRS cannot determine if there is a tax liability with the IRS, you will need to make any necessary adjustments or payments on your Form 107 in order to correct the problem. If you owe taxes, you should consider filing a separate return for the tax year in which the erroneous return was received. Remember, it can take the IRS some time to determine if there is a tax liability with the IRS on your incorrect return.

If you filed Form 107 electronically, it will be processed and filed electronically.

If you filed the form by mail, you will receive a printed PDF with a copy of the Form 107 and a return address; but you will not receive a return from us, so please do not send an email or request a return with your form.

The IRS will respond to you personally before mailing a return to you.

When should I have Form 760 returned, and when should I start the process again?

We strongly encourage you to fill out Form 760 to resolve any tax liability. The IRS will not automatically close your file at the conclusion of the information provided; however, you may need to resubmit certain documents to the returns' processor to complete the processing process.

How do I resubmit the Forms 107 if I can?

You may resubmit the Forms 107 in the same manner as you signed them.

How do I get my Form Fincen 107?

To get a copy of Form Fine 107, you should first fill out a paper application; then, you must mail the application to the address on the form. We recommend this method so as not to be delayed on the basis of an incomplete application.

There are three options for printing and mailing your Form Fine 107:

For a print or faxed copy of Form Fine 107:

Mail the form to any address listed on the form

The paper form must contain a postage stamp (a physical stamp) or a scanned image of the paper form to validate its authenticity

The PDF file that is provided on the site should be a complete copy of your Form Fine 107

If you prefer to mail Form Fine 107 by fax:

To get a printed copy of Form Fine 107:

Fax your completed Form Fine 107 to the fax number listed above

The PDF file that is provided on the site should be a complete copy of your Form Fine 107

If your Form Fine 107 has a scanned image or paper attachment, we will print off a copy and mail the scanned or paper copy of the form to you. We recommend this option as an extra measure of security to ensure that you are getting a valid copy of our Form Fine. It takes only a few minutes to complete the online process.

If you have a hard copy of Form Fine 107, you will need to send it to us by mail to the following address:

U.S. Bankruptcy

Attn: Legal Department

PO Box 898

St Louis, MO 63

For a print or faxed copy of Form Fine 107:

Mail the Form Fine 107 to the address listed on the form.

What documents do I need to attach to my Form Fincen 107?

If you want to file a request to amend or correct your Form Fine 107 application, you must submit original documents to a state or local government agency in writing. These documents must be originals. The documents you use will be used to complete your application and, if necessary, the original document will be returned to you. Copies of the original documents sent with your Form Fine 107 application can be used to verify any additional information you add to your application.

How do I file a request to amend or correct my Form Fine 107 application?

If you want to file a request to amend or correct your Form Fine 107 application, provide original documents to a state or local government agency in writing. These documents must be originals. The documents you use will be used to complete your application and, if necessary, the original document will be returned to you. Copies of the original documents sent with your Form Fine 107 application can be used to verify any additional information you add to your application.

Do I have to file Form Fine 107 if my application is approved, and I received a notice of approval?

Yes. If you applied for a Form Fine 107 and received a notice of approval, you must file form 107 to change your address on your Form Fine 107.

What documents do I need to attach to my Form Fine 107?

If you want to file a request to amend or correct your Form Fine 107 application, you must attach original documents to a Form Fine 107 application. These documents must be originals. The documents you use will be used to complete your application and, if necessary, the original document will be returned to you. Copies of the original documents sent with your Form Fine 107 application can be used to verify any additional information you add to your application.

When will I understand what to do if I believe I have made a typographical error in my Form Fine 107 application?

The application instructions for your filing option explain the process for correcting a typographical error.

Do I have to file a Form Fine 107 for any other change in my address, such as a change in employment?

If the address on your Form Fine 107 is changed because you have changed your place of work or employment, you must file a new application before changing your address.

What are the different types of Form Fincen 107?

There are two main kinds of Form Fine 107:

Type 1:

This form does not require a tax return.

You may use this form to request the following tax returns:

GST/HST return

GST/HST rebate returns

If you are filing a GST/HST rebate claim for an eligible transaction, you will be asked to complete Form GST120 or Form GST125. If you are not a rebate claim payer, you must provide a statement of the GST/HST you received for the eligible transaction.

Type 2:

You must use this form if you are a rebate claim payer, to file your GST/HST return. If you are not a rebate claim payer, the other types of form are valid forms for your tax return. The following sections explain what you need to do.

To submit a Form GST120 or Form GST125

Use online services. You can submit your Form GST120 online or through the Canada Revenue Agency's filing service.

If you are filing electronically, file and print a completed and signed GST return.

If you are filing paper, you will need to complete an E-Z file, form GST120, or Form GST125 and send it to us electronically.

You will need to provide your client number, client first name and client last name (if you're submitting an electronic tax return), the transaction number, the type of payment (if an electronic payment is made), and the amount of the transaction. The client number and client first name and client last name can be found on the back of your client statement. A client number and client first name and client last name are required for filing on behalf of a person.

Complete the GST/HST return. Include your client numbers and client first names, if you are filing on behalf of a person on an individual tax return. The tax return must be filed online with the CRA. If you are a GST/HST rebate claim payer, or if you want to complete a return electronically, include the information required on Form GST120 or Form GST125. For more information, see: What are the different types of Form GST?

Additional information for GST/HST rebate payers

If you submit a Form GST120 or Form GST125, you must also indicate whether you are filing a GST/HST rebate claim for an eligible transaction.

How many people fill out Form Fincen 107 each year?

Since 2002, over 1,100,00 individuals have filled out Form 107. The median age of the population is 34 years old as of June 2012.

As a comparison, over 400,000 individuals submitted a Form 1040 during 2009, the most recent year for which the IRS published aggregate results under the Table A-23.

When are the IRS's Form 1040 aggregated results?

The IRS publishes aggregate results for individuals with AGI over 100,000 and individuals with AGI over 200,000 each year.

How much time do I have to submit all taxes (and fees)?

Filing times vary depending on income and filing type (self, married filing separately, head of household). More information about the different stages of the process can be found at the IRS's website: Tax Filing Calendar.

Are there extensions or exceptions to the deadline specified in the Form 1040?

Yes. Most returns are timely filed through the normal filing season (March 15 to June 15) except with certain income, filing status, or type of tax filing. Extensions or exemptions can be requested on Form 4868 (the taxpayer's request for an extension).

Are tax forms for the past five years (FBI/957-DIV, F-1B Visa, W-2, and W-9) accepted for filing taxes?

Yes. The form 957-DIV, F-1B Visa, W-2 and W-9 are accepted.

Will you accept an extension to file?

Yes, an extension is available to help you file your taxes on time. You'll receive an Extension Notification Letter within five business days of the date your return was due.

Who can help me file my taxes?

Individuals — the IRS can help you make tax payments on your own. The IRS office nearest you can help you with filing, account management, filing the return online, checking your e-filed return, and filing a claim for refund. For more information about individual filing assistance, visit IRS.gov and go to Form 7095, Individual Income Tax Filing Assistance.

Businesses — If you have more than three employees, the IRS may offer you a free paper filing service. To learn more, visit IRS.

Is there a due date for Form Fincen 107?

It is our goal to comply with all applicable reporting requirements with respect to Form Fine 107. In particular, we are required to file a Form 1466 or 1472 with respect to such reports no later than 180 days after the financial statement date on which the information in the forms is first made available to our audit and examination committees. We have no present intention to amend the information in the forms.

The Internal Revenue Code of 1986 specifies that a “whistleblower” is any person who discloses to a “federal, state, or local government agency or authority” information knowing the information to be false; knowing it to be false in a material respect; and with the intent to injure or to defraud any person or entity.

Is there a due date for Form Fine 107?

Not applicable and therefore, no Form Fine 107 was required to be filed.

What if, as of June 30, 2017, we have not yet complied with the reporting requirements described above with respect to Form Fine 107, and Form 1466 or 1472 was filed only to notify us of the disclosure?

If, on June 30, 2017, a Form 15-A, Statement of Changes in Shareholder and Principal Account, for each such shareholder and principal account is not timely filed with us, then the following information would be deemed not to have been disclosed to us under Form Fine 107:

• Amount of shares held and outstanding as of the date the Form 15-A, Statement of Changes in Shareholder and Principal Account, was filed;

• Number of shares held prior to the date the Form 15-A, Statement of Changes in Shareholder and Principal Account, was filed;

• The dollar amount of dividends paid and the total amount of the unpaid interest with respect to dividends paid as of the date the Form 15-A, Statement of Changes in Shareholder and Principal Account, was filed; and

• All references to dividends paid, including amounts paid in the future.

Any of the material facts disclosed in a Form 15-A, Statement of Changes in Shareholder and Principal Account that are known to us on or after July 15, 2017, are covered by a Form 15-A, Statement of Changes in Shareholder and Principal Account.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here